A bank takes in money from depositors and then uses it to fund lending activity, be that home mortgages, credit cards, or the purchase of government bonds among other options. The biggest concern this week has been around deposit bases. However, there can be various issues that crop up with this. After all, the classic banking business is borrowing short to lend long and collecting the spread. That's the concept behind holding to maturity.Īnd there's nothing wrong with this model on the face of it. After all, the intention is to collect interest and then be repaid when the bond matures. Normally, banks don't have to fret too much about day-to-day changes in the value of the bonds that they own. A look at the benchmark iShares 20+ Year Treasury Bond ETF ( TLT) shows the stark nature of the recent declines in government bond values:īanks that had loaded up on Treasury bonds when the TLT was at, say, 160, are now looking at major unrealized losses on those positions.

As yields have gone up a long way, prices for previously issued bonds have dropped to an elevated degree. When bond yields go up, prices for existing bonds go down. This was when interest rates were much lower than they are today. In English, financial firms bought a lot of long-dated bonds, such as U.S.

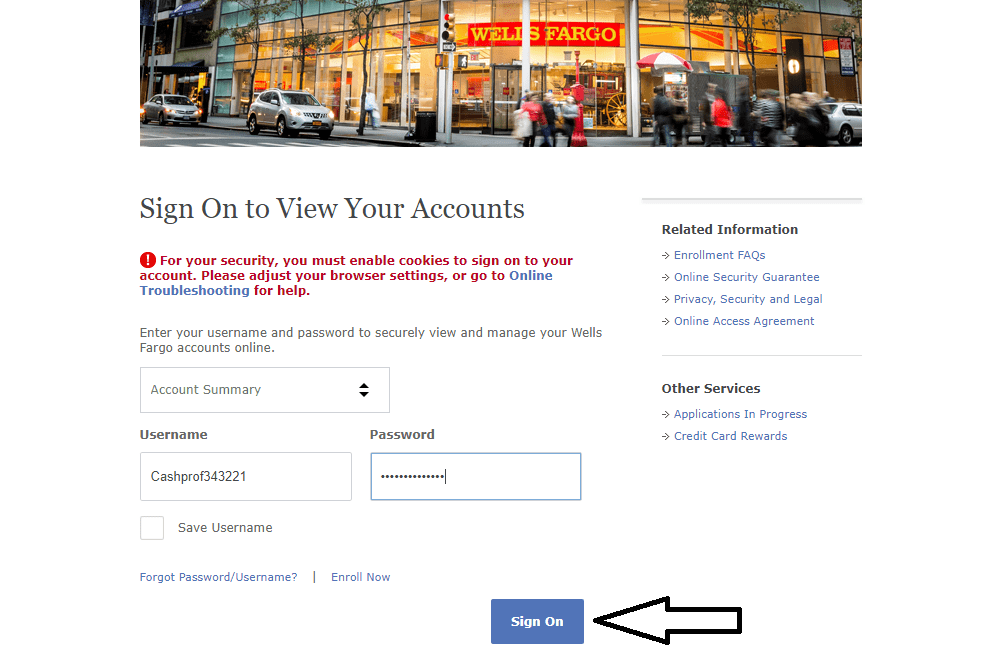

:max_bytes(150000):strip_icc()/Wells_Fargo-9cea2a7afa13456fb4a583ec4fab83a5.jpg)

This may seem technical but I'll try to explain. The central factor are held-to-maturity "HTM" securities. And yet the market is taking a similarly dim view of their outlooks. We've seen absolute drubbings in a number of regional bank stocks over the past few days:Įven some firms that aren't primarily thought of as banks, like Charles Schwab ( SCHW), have seen their shares get pounded as the market is now re-evaluating any and all forms of interest rate risk and duration mismatch between assets and liabilities.Ī cryptocurrency-related bank, a Silicon Valley specialty bank, and a leading brokerage firm all operate different business models. SVB's collapse has led to a contagion effect across the banking industry, especially in certain niche financial companies. That didn't keep the problems away, however, as the FDIC intervened and made a speedy move to shut down SVB's operations during market hours on Friday. The bank announced its capital raise had failed on Friday morning, and that it was putting itself up for sale. Even though the bank had held a market capitalization in excess of $15 billion not long ago, it was unable to raise the desired amount of capital. SIVB stock cratered Thursday on the news of this large equity offering.

Earlier this week, SVB Financial ( SIVB), the holding company for Silicon Valley Bank, attempted to raise $1.7 billion in fresh capital to plug a hole in its balance sheet. Silvergate was not a particularly huge firm, and as such, it didn't send shockwaves through the market.īut closely following Silvergate's decline, a much bigger firm ran into trouble. Silvergate was unable to effectively plug the hole in its balance sheet leading to the bank suspending operations and shareholders seeing a near total wipeout in value. However, Silvergate ran aground after its business pivot into cryptocurrencies led it to a massive withdrawal of deposits last year. That was an abrupt end for the firm which had been in business since the 1980s. Earlier this week, we heard that Silvergate Capital ( SI) would be winding down operations and liquidating its underlying Silvergate Bank. The banking industry has had a week for the ages.

0 kommentar(er)

0 kommentar(er)